2024 Federal Income Tax Brackets Single

2024 Federal Income Tax Brackets Single. As your income rises it can push you into a higher tax. Check your 2024 irs federal income tax bracket to see if you fall into a lower bracket due to inflation, which could lower your tax bill next year.

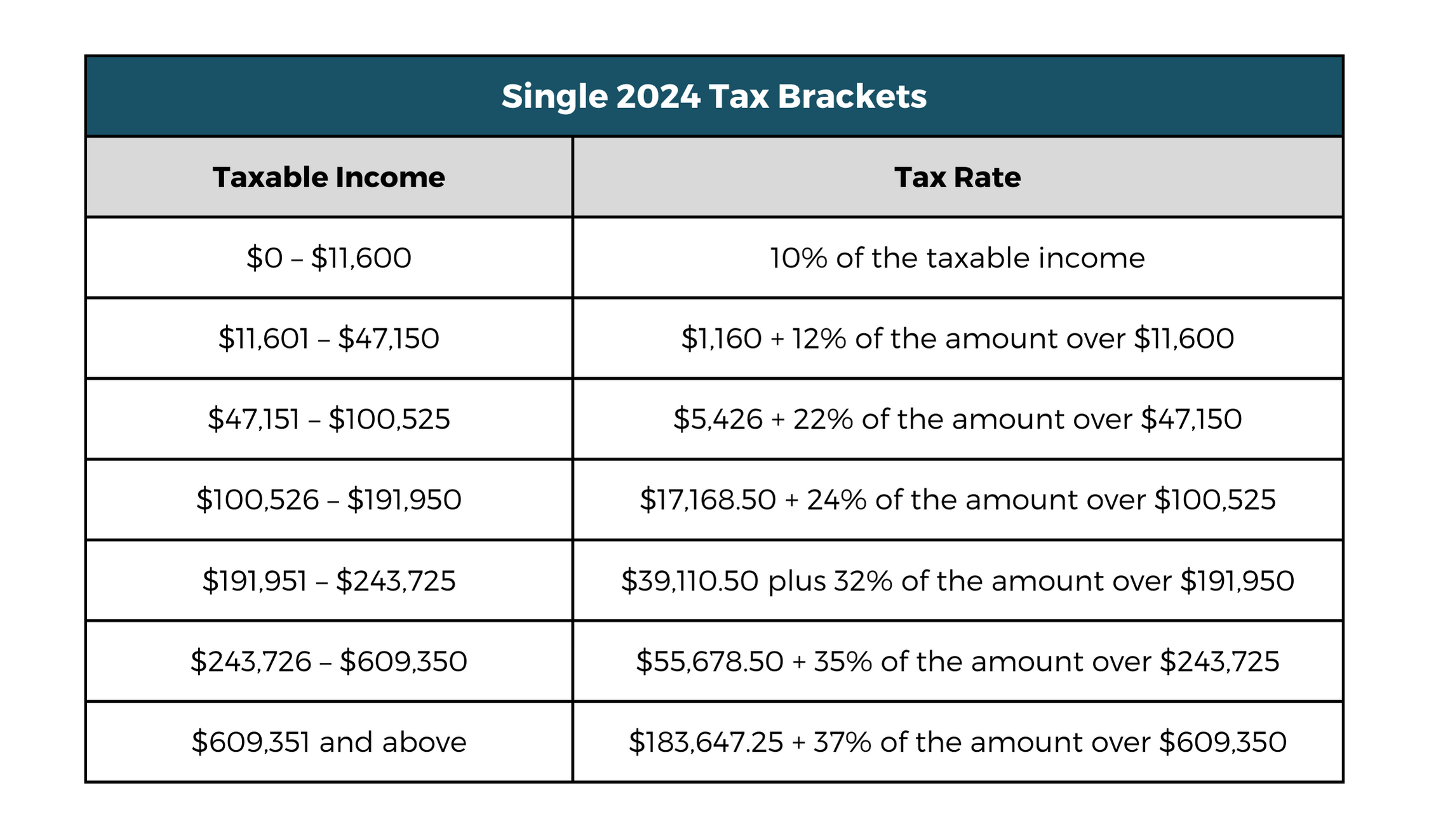

Here are the 2024 federal tax brackets. For 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

10%, 12%, 22%, 24%, 32%, 35% And 37%.

If you make $70,000 a year living in wisconsin you will be taxed $10,401.

Taxable Income(Single) Taxable Income(Married Filing Jointly) 10%:

The highest earners fall into the 37% range, while those.

Single Filers And Married Couples Filing Jointly;

Images References :

Source: tiffaniewmegen.pages.dev

Source: tiffaniewmegen.pages.dev

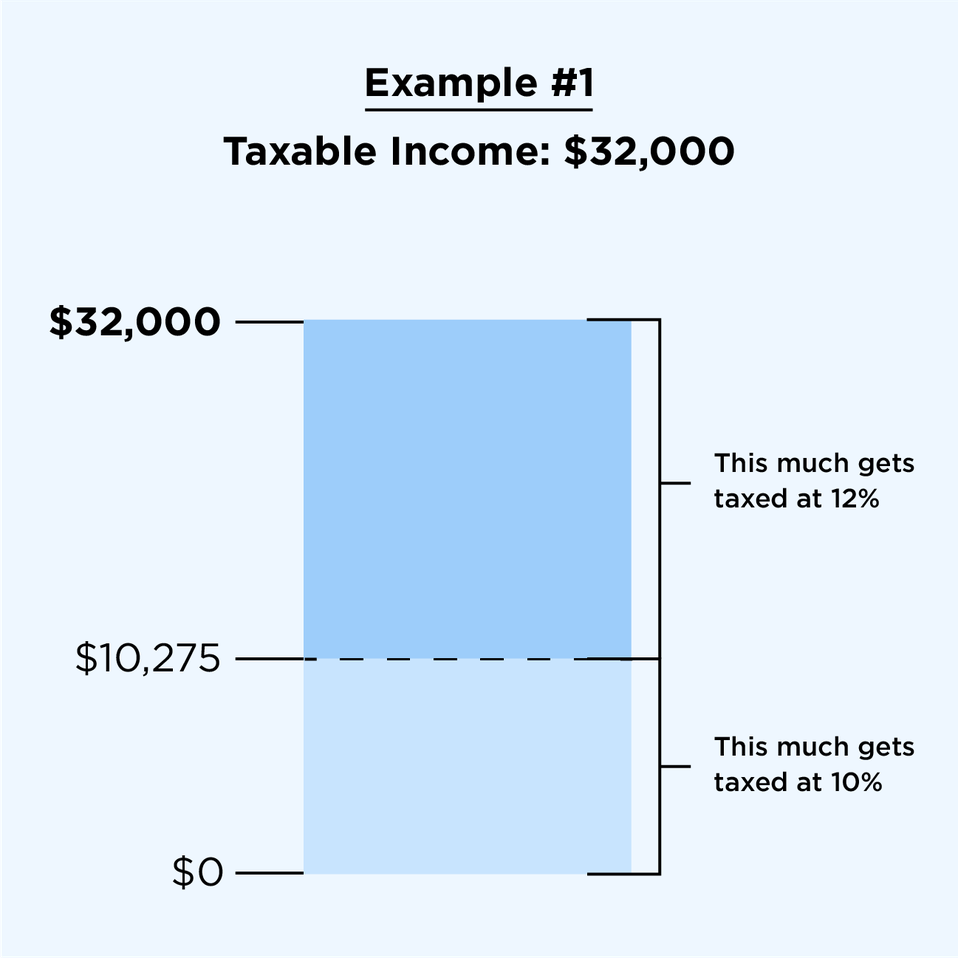

2024 Tax Brackets Mfj Limits Brook Collete, The irs uses 7 brackets to calculate your tax bill based on your income and filing status. In 2024, the first $11,600 of taxable income will fall into the.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2024 Elene Hedvige, In 2024, the first $11,600 of taxable income will fall into the 10% tax bracket, which means $600 of additional income will be taxed at 10%, instead of 12% in the. The 2023 federal income tax rates will stay the same from 2022.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2024 Elene Hedvige, For 2024, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers. The highest earners fall into the 37% range, while those.

Source: verieewlola.pages.dev

Source: verieewlola.pages.dev

Federal Tax Brackets 2024 Single Mela Stormi, Federal tax brackets 2024 married. For 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: dolliqjuieta.pages.dev

Source: dolliqjuieta.pages.dev

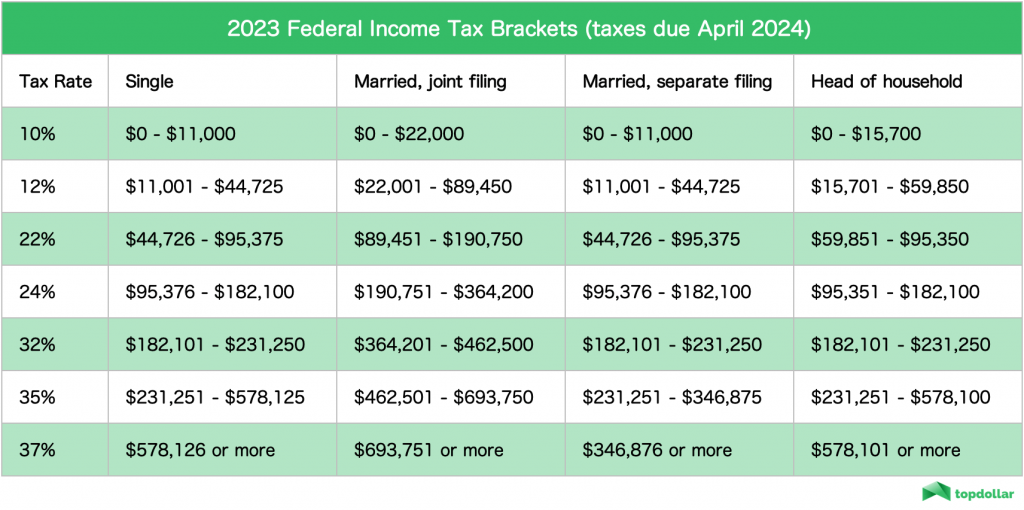

Tax Brackets 2024 Irs Single Elana Harmony, As noted earlier, the 2024 federal income tax rates consist of seven brackets: Federal income tax rates and brackets for 2023.

Source: www.nerdwallet.com

Source: www.nerdwallet.com

20232024 Tax Brackets and Federal Tax Rates NerdWallet, 10%, 12%, 22%, 24%, 32%, 35% and 37%. 2024 tax brackets (taxes due in april 2025) the 2024 tax year, and the return due in 2025, will continue with these seven federal tax brackets:

Source: sherrywdru.pages.dev

Source: sherrywdru.pages.dev

2024 Standard Deductions And Tax Brackets Helene Kalinda, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37. As your income rises it can push you into a higher tax.

Source: www.taxuni.com

Source: www.taxuni.com

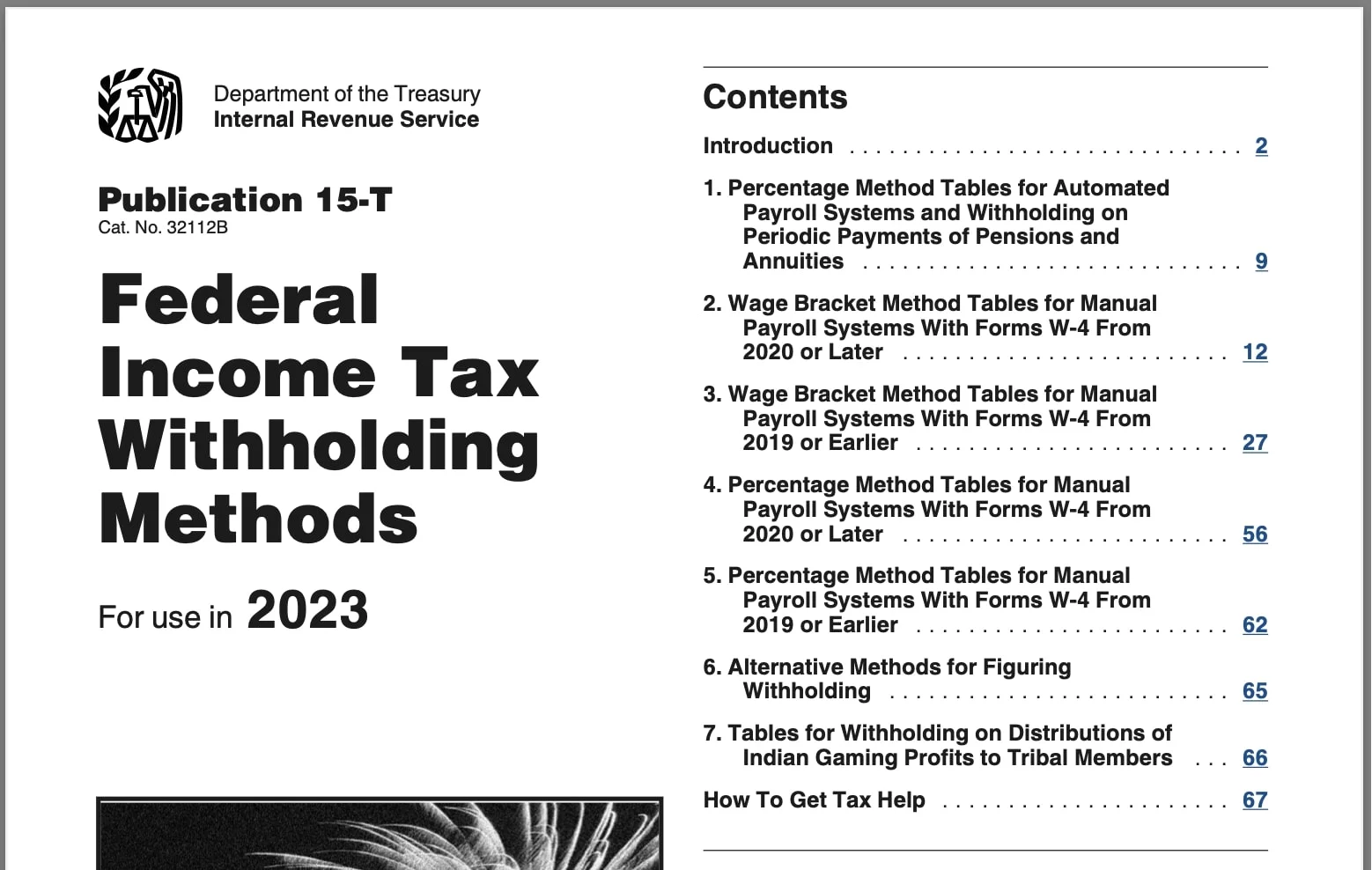

Federal Withholding Tables 2024 Federal Tax, In 2024, there are seven federal income tax rates and brackets: For 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: jeaninewfred.pages.dev

Source: jeaninewfred.pages.dev

Irs 2024 Standard Deductions And Tax Brackets Loni Marcela, In 2024, the first $11,600 of taxable income will fall into the 10% tax bracket, which means $600 of additional income will be taxed at 10%, instead of 12% in the. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: calendar.cholonautas.edu.pe

Source: calendar.cholonautas.edu.pe

Tax Rates 2023 To 2024 2023 Printable Calendar, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

For 2024, The Seven Federal Income Tax Rates Are 10%, 12%, 22%, 24%, 32%, 35% And 37%.

The highest earners fall into the 37% range, while those.

Check Your 2024 Irs Federal Income Tax Bracket To See If You Fall Into A Lower Bracket Due To Inflation, Which Could Lower Your Tax Bill Next Year.

For 2024, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers.